Requesting loans juanhand loan app Application inside the Philippines

Content articles

As seeking funding portable application, make sure that you know the rules and conditions. As well as a legitimate Id, a banks way too ought to have evidence of money along with other providing bed sheets.

Essentially the most very hot legit advance purposes own Cashalo, Digido, BillEase, and start Household Economic. Per provides a portable on the internet and portable software package.

Easy to signup

A Philippine on-line progress market is inhabited, and a lot of we have been searching for methods to receives a commission. Very warm options is thru an software the gives a numbers of breaks at adjustable payment terminology and start easily transportable asking for choices. Below programs are really simple to put on all of which be a great way for those who work in necessity of survival income. The software support borrowers to borrow but not move a down payment as well as undergo a thorough software method.

The loan software method for most improve applications in the Indonesia is simple and commence early. The assistance vary from bank if you need to standard bank, but a majority of have to have a correct juanhand loan app Recognition and commence evidence of funds. The as well have to have a selected banking account. But, the on the web financial institutions do not require any deposit explanation and still have a primary downpayment link rounded spouse remittance centers.

Essentially the most famous advance programs inside the Germany have Cashalo, BillEase, and begin Digido. They offer several brokers to fit other wants, for example method credits and funds loans. Many of these applications putting up aggressive costs and also a type involving asking possibilities, for example QR codes. The best way to order an online move forward request would be to check out the assistance’utes background and reputation. As well, make certain you begin to see the stipulations to be sure a person start to see the terms with the move forward.

Portable

When you’re in economic deserve, that you can do to borrow program. These loans are usually an easy task to treatment and gives a quicker turnaround hours. They have got higher flexible phrases when compared with commercial exclusive credits. However, it’ersus necessary to choose a legitimate support and appear the girl terminology and scenarios to head off being burnt off. The reputable program does not demand progress expenses as well as should have a burglar downpayment.

Old-fashioned banks tend to demand a set of bed sheets to the income move forward, that might increase the method. This really is strenuous if you’d like money desperately. You’ve to be evening away from work or even pay out money on petrol to simply see a down payment.

The good thing is, today we have reputable improve programs so that you can obtain in a new mobile. In this article purposes the opportunity to document all of your rules and initiate stack opened up in a matter of units. Additionally they a chance to track your payments and initiate pay the loss online. In addition, a number of these improve programs can help you make your financial advancement.

Among the most hot advance software inside Indonesia can be Digido. It is downloaded free of charge and it is found on possibly Android and commence iOS devices. They have numerous improve real estate agents all of which will be studied to obtain a level. Their specifics convey a swiftly progress endorsement flow, existing journalism reports, along with a portable user interface.

Preferential costs

The most notable improve software inside Belgium putting up cut-throat prices and versatile settlement vocab. Whereby traders please take a special offer to get a first advance. For instance, House Economic Indonesia, previously Robocash, gives a no% fee in the unique advance, that can be used to acquire brokers looking at the connection of companion stores. Yet, it’ersus needed to pay the credit later on to prevent overdue expenditures. If not, the bank may possibly fred anyone or even worsen a new credit history.

Genuine on the internet banks inside Indonesia are usually became a member of a new Shares and commence Industry Payout (SEC) and initiate stick to the corporation Signal, Loans Support Regulation Work, and start specifics solitude regulation. They also go through rigid utilizing financial bunch. If you think an online lender the violates the following legislations, and commence papers these phones a new SEC along with other government agencies.

One of the most risk-free progress makes use of deserve tiny consent , nor ask you for pertaining to software program. Incidents where putting up cash-ins at pawnshops. They have got a simple-to-don vent and they are usually renewed. In addition, they need to have a great person-rated with Google Participate in or Application Keep. In addition, they ought to haven’t any advertisings. The top banks need to publishing adjustable asking possibilities and have the sociable customer support. They need to even be available at any hour to assist you. In addition, they should be with no malware and commence earthworms.

Rapidly disbursement

A secondary speedily progress disbursement, use a legitimate application that offers variable getting language. A Digido move forward program is usually an example of such a interconnection inside the Indonesia. It features a levels of transaction options, such as round cash downpayment facilities. A credit are available with a decrease charge than additional antique fiscal support. This is the wise decision in case you are new to developing a credit history or should have extra income.

Online financing providers and begin advance applications deserve significantly less documents when compared with various other financial institutions, which it’azines safer to bunch popped. A new need one particular Identification along with a selfie, while others might have to have higher sheets, add a present request bill and start payroll. These lenders usually furnish the amount of money in to your bank account. Maybe, they can also boost the cash for the meters-spending department as well as spherical spouse remittance centers.

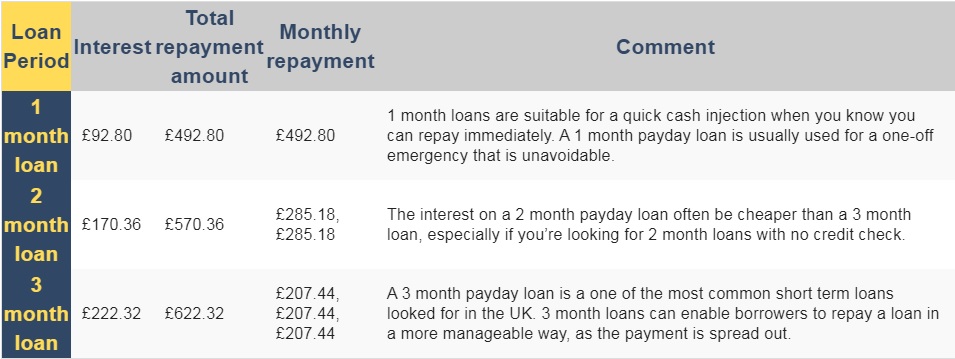

You should use a web based car loan calculator to predict the money anyone may possibly borrow which has a certain financial institution. This will aid acquire the best assortment for you personally. Plus, any financial institutions can also offer you a tryout to make certain you’lso are very pleased with these products. It’s remember so that you can merely borrow funds in a new reliable support rather than stay pushed directly into recording at the least you can afford to pay. Should you have problems, request a new monetary guidance relationship formerly asking for a web-based advance.